Deposit Check

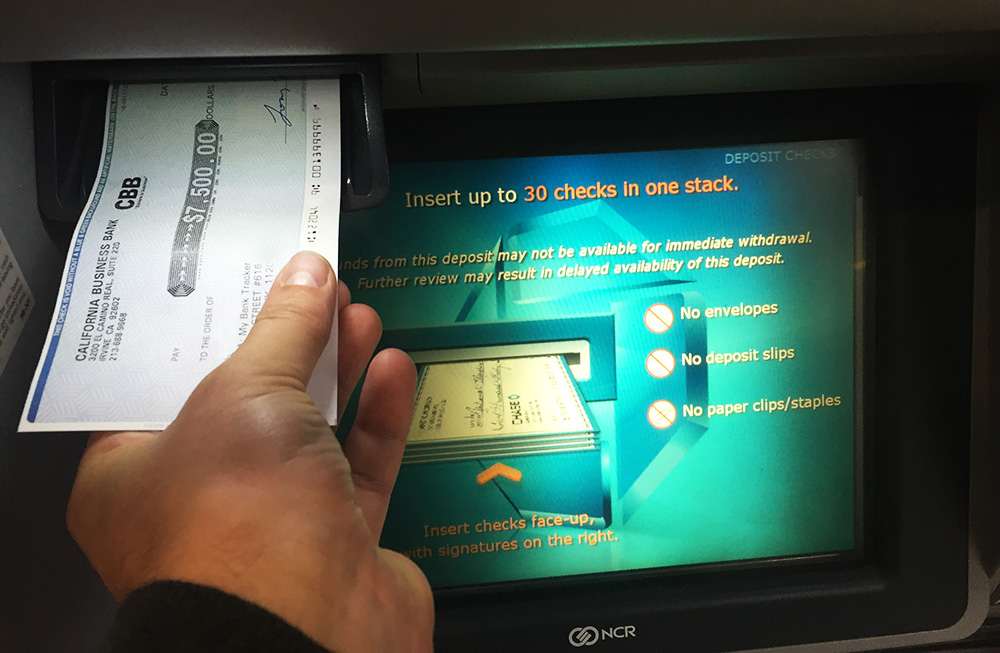

Car wrap decals.People interested in car wrap advertising are told to deposit checks and send money to decal installers — who don’t exist.; Claiming prizes.Sweepstakes “winners” are given checks and told to send money to cover taxes, shipping and handling charges, or processing fees. But that’s not how legitimate sweepstakes work. Deposit your check. Direct the funds to the appropriate account, such as your checking or savings. Fill in the amount of the check using the app, and confirm all information is correct on the confirmation screen. If it is, click “Submit” or 'Deposit this Check.' You should receive a text or email when the check has been deposited. Deposit your check via mobile banking. Now you’re ready to deposit a check online! The process can be different depending on your particular bank account. But generally, here’s what you need to do: Log into your mobile banking app; Find the mobile check deposit option in the menu. In the Chase Mobile ® app, choose “Deposit Checks” in the navigation menu and select the account. Enter the amount of the check and tap 'Front'. With our 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually. You can make unlimited deposits into your Money Market, Online Savings and Interest Checking accounts. If you are using Ally eCheck Deposit℠, you’re only allowed to deposit checks totaling $50,000 in a single day and up to $250,000 every 30 calendar days.

Point. Click. Deposit. See how easy it is to deposit a check using the MyMerrill Mobile app!

MyMerrill Mobile Check Deposit

Mobile Check Deposit on the MyMerrill mobile app allows you to securely and conveniently deposit checks anytime and anywhere into eligible Merrill investment accounts.

Once you log into the MyMerrill mobile app:

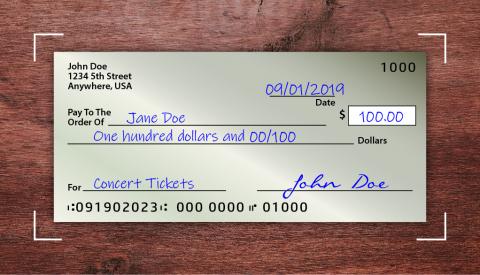

- Tap on the check deposit icon.

- Using your device’s camera, take a picture of both

sides of the check. - And remember to sign the back.

- Select your deposit to account & enter the

amount. - Tap continue to verify the deposit, and lastly

finally, tap “make deposit” to process therequest.

A confirmation notice will appear on the screen letting you know it the check was accepted.

- You may can check the status of your deposit at

any time by returning to the app,selecting “check deposit” and then “view status.” - Deposits made after 7:30 p.m. Eastern Time will

be processed on the next business day. - It may take up to eight days before you can invest

or withdraw the funds. - The check should be kept for 14 days to ensure

the issuer has honored the payment.

Mobile check deposit provides you a secure and convenient option right from your home!

How To Make A Mobile Deposit

Important Information:

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BofA Corp.

Investment products:

Deposit Checks Online

- Are Not FDIC Insured

- Are Not Bank Guaranteed

- May Lose Value

Nothing discussed or suggested in these materials should be construed as permission to supersede or circumvent any Bank of America, Merrill Lynch, Pierce, Fenner & Smith Incorporated policies, procedures, rules, and guidelines.

Neither Merrill Lynch nor any of its affiliates or financial advisors provide legal, tax or accounting advice. Clients should be instructed to consult with their legal and/or tax advisors before making any financial decisions.

© 2020 Bank of America Corporation. All rights reserved.